Bandera County commissioners have given their approval to a tax rate of $.559500 per $100 valuation for the upcoming 2023-24 fiscal year. This represents an 8.2 percent decrease from the previous year's tax rate. However, property owners in the county may still experience an increase in their property tax statements due to a 12.89 percent increase in the average homestead taxable values. As a result, the tax on the average homestead has risen by 3.61 percent.

Pct. 2 Commissioner Greg Grothues voiced his opposition to the proposed tax rate and was the sole dissenting vote.

County officials, including County Judge Richard Evans, emphasized that while property values have seen an increase, the approved tax rate remains lower than the voter-approval tax rate of $.629448 per $100 valuation. This higher rate would require an election for adoption.

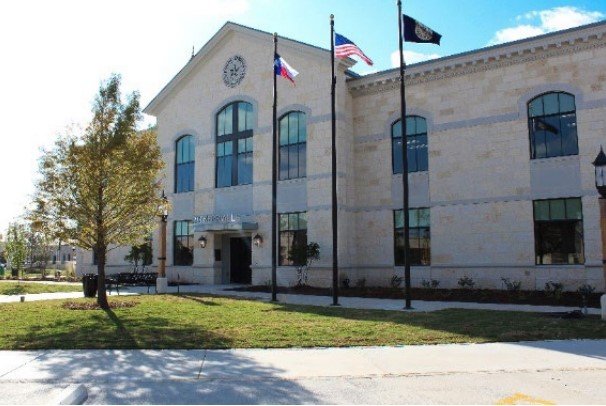

Judge Evans emphasized that the county's tax rate is set based on the essential services it needs to provide to its residents, including vital services such as EMS, the Sheriff's Office, the Jail and Justice Center, and Road and Bridge, which are necessary for the county's proper functioning.

"The bottom line is your tax rate is going down one nickel this year. It went down 12 cents combined in the last three years," stated Judge Evans, highlighting the efforts to keep taxes manageable for the local community.